Portfolio Management may be the most important, misunderstood, and underappreciated function in pharma. No one questions the purpose of Quality Assurance, Regulatory Affairs, Research and Development, Finance, or Supply Chain Management in the modern-day pharmaceutical industry. Their functions are entirely self-evident.

Portfolio Management, a relatively new addition to the pharmaceutical industry, was not a term commonly associated with pharma when I began my career. It was a concept more often associated with stockbrokers. Initially, what we now refer to as Portfolio Management was confined to selecting new project candidates. Even today, many organizations limit their understanding of Portfolio Management to this narrow definition. Candidate selection is often seen as “just another task” for the Business Development team or even the sole jurisdiction of the CEO, rather than a strategic management process.

While candidate selection is undeniably a crucial part of Portfolio Management, it is merely one element of a complex puzzle. This puzzle, unique to each organization, requires careful tailoring to meet its specific needs and objectives. As I often say, a generic portfolio is anything but ‘generic’. If it were, I could provide a list of products right here, saving us all a lot of time and effort. This underscores the need for a strategic and individualized, rather than opportunistic and general, approach to candidate selection.

Effective Portfolio Management in the pharmaceutical industry requires a holistic approach. It’s not just about selecting new products but about ensuring a steady flow of new products that can generate new revenue. Approaching it as a stand-alone task can lead to various adverse outcomes:

• Too few projects, and revenue targets cannot be met.

• Too many projects entering the pipeline will create bottlenecks and delays, again negatively impacting revenue.

• The wrong mix of product candidates may be selected. Core competencies and competitive advantage must drive the portfolio.

• A lack of “ownership” – responsibility and accountability from ideation through launch.

This last point, ownership of the process of New Product Introduction (NPI), is absolutely critical and is the mindset that must guide everyone in Portfolio Management leadership. Imagine a philharmonic orchestra without a conductor. Although the conductor doesn’t play a single note on a single instrument throughout the performance, no one doubts that it is they that ensures that each musician in each section of the orchestra knows their exact part, and plays to an exacting tempo and modulation, so that the end result is a perfection of musical harmony.

Similarly, in a well-orchestrated NPI process, it is the ownership and unified approach that will lead us to success.

As one who has had the opportunity to create portfolio management processes for numerous large pharma organizations, I find it inexcusable that many companies do not have a discrete Portfolio Management function. This is either because they do not appreciate the need for such a holistic and strategic function within the organization or because they do not appreciate the full scope of activities that should be orchestrated by a single strategic management function in order to efficiently and effectively deliver the pipeline that is the company’s most important engine of growth.

When the philharmonic plays flawlessly, we may forget that the conductor exists, and even wonder what that role entails. It is only when things go horribly wrong that all fingers point in one direction. Portfolio Management may sound like a thankless role, but in my experience, ensuring that the music is played in perfect harmony is the most frustrating, fascinating, rewarding and fulfilling role within the modern pharma organization.

Goals, roles, and responsibilities:

A. Deliver the pipeline!

The roles and objectives of the Portfolio Management function have evolved considerably since the term was first used in pharma barely twenty years ago. What started as an exercise in identifying new product candidates for the future pipeline has evolved into a nuanced and overarching governance process designed to deliver continuous revenue growth for the organization even in the face of eroding income from the existing commercial product portfolio. This responsibility includes identifying stakeholders, managing the dialogue, ensuring transparency and communication, challenging assumptions, and ensuring a rational decision-making process in all aspects of the New Product Introduction. At least, this is my expectation of a sophisticated Portfolio Management organization.

In short, the roles of Portfolio Management can be divided into two:

1. Portfolio Selection: Curating and maintaining a nuanced new product portfolio matching the organization’s financial needs, core competencies, capabilities, and resources. This is achieved by co-opting the stakeholders responsible for bringing those products to the organization (e.g., R&D, BD, RA) and those responsible for delivering the products to the market (e.g., sales, marketing).

2. NPI Process Governance: Managing the overall

cascade of processes that the organization needs to ensure skillful planning and control of the portfolio of projects through communication and on-time decision-making at each stage of the NPI process, together with those responsible for execution and delivery across all key functions.

Portfolio Strategy is derived from corporate strategy:

A. Financial Goals:

Portfolio Management does not exist as an end goal on its own but is a means to an end. Thus, portfolio strategy must be derived from corporate strategy. The number of new product candidates that need to be selected for the portfolio and the revenue expected from each will be determined by top-line goals for growth as well as the level of risk that the organization is willing to assume. Before getting started we must understand the corporate goals and the strategy to attain those goals.

1. Financial goals: Do we need to satisfy a modest five percent increase in annual revenues, an aggressive 20% increase or something in between? Clear direction from corporate management is key to understanding how much revenue from new product launches must be generated yearly.

2. What is the appetite for risk? Do we target a small number of “high-risk/high-reward” projects or a much larger number of “safe” projects of lower value but a higher probability of success and bringing increased diversification?

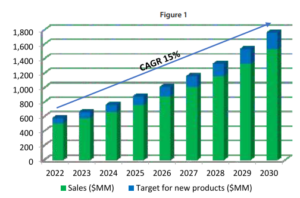

Figure 1, illustrates a simplified example of a 15% compound annual growth rate (CAGR). The blue section atop each bar represents the target value of the pipeline needed year by year. This pipeline could consist of a small number of high-revenue products (higher risk) or a larger number of lower-revenue products (lower risk), but the revenue target must be met.

Figure 1, illustrates a simplified example of a 15% compound annual growth rate (CAGR). The blue section atop each bar represents the target value of the pipeline needed year by year. This pipeline could consist of a small number of high-revenue products (higher risk) or a larger number of lower-revenue products (lower risk), but the revenue target must be met.

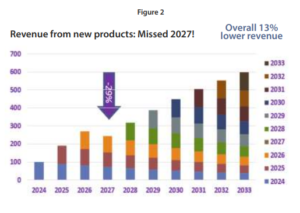

The tool represented in Figure 2., identifies whether the project plan provides sufficient value to meet the growth targets in each future year. If a shortfall is identified far enough in advance (in this example, 2027), it can be compensated for by augmenting the pipeline. This year-by-year forecast must be updated regularly based on project progress to allow ample time to compensate should any projects be delayed or canceled, leaving a significant gap between the revenue target and the forecast.

The tool represented in Figure 2., identifies whether the project plan provides sufficient value to meet the growth targets in each future year. If a shortfall is identified far enough in advance (in this example, 2027), it can be compensated for by augmenting the pipeline. This year-by-year forecast must be updated regularly based on project progress to allow ample time to compensate should any projects be delayed or canceled, leaving a significant gap between the revenue target and the forecast.

Mike served at Teva Pharmaceuticals for 24 years in increasingly senior positions in Generic R&D and Portfolio Management, where he led the Portfolio Management team for Teva Europe, finally reaching the position of Vice President Generic R&D for the Teva International Group. After leaving Teva Mr. Teiler joined Taro Pharmaceuticals (a Sun Pharma company) as Group Vice President, Portfolio Management where he created this role and established processes for candidate selection, R&D project management, and global launch management. In addition, Mike was responsible for the project management of Sun Pharma’s R&D, where he was responsible for creating the Project Management function, introducing Critical Chain Project Management and led the implementation effort. Since leaving Taro in 2017, Mike has been working as a consultant, providing strategic portfolio management guidance to generic pharma and API companies as well as strategic biotech consulting and guidance to numerous startups in the pharma, device, cosmetics, and supplement space.

Mike served at Teva Pharmaceuticals for 24 years in increasingly senior positions in Generic R&D and Portfolio Management, where he led the Portfolio Management team for Teva Europe, finally reaching the position of Vice President Generic R&D for the Teva International Group. After leaving Teva Mr. Teiler joined Taro Pharmaceuticals (a Sun Pharma company) as Group Vice President, Portfolio Management where he created this role and established processes for candidate selection, R&D project management, and global launch management. In addition, Mike was responsible for the project management of Sun Pharma’s R&D, where he was responsible for creating the Project Management function, introducing Critical Chain Project Management and led the implementation effort. Since leaving Taro in 2017, Mike has been working as a consultant, providing strategic portfolio management guidance to generic pharma and API companies as well as strategic biotech consulting and guidance to numerous startups in the pharma, device, cosmetics, and supplement space.

In Figure 2, we demonstrate forecasted value growth year on year despite the erosion in value of the existing commercial portfolio. In this example, no new products are forecast for commercialization in 2027, leaving a gap that must be filled to meet revenue growth targets.

B. Core competencies create competitive advantage:

The capabilities that define a company’s competitive advantages in the market are shaped by corporate strategy in response to the corporate vision. The products we need for the pipeline and how they are obtained will be derived from current and future capabilities.

Commercial: What commercial channel do we address? Products sold through a retail channel will, for the most part, be very different from those targeting hospitals. Targeting rare diseases through specialty pharma? Again, a unique pipeline of candidates to be selected.

Technical: Competitive advantages include the ability to develop, register, and manufacture a particular type of product quickly, efficiently, and at low cost. For example, if the core competency of the company is Modified-Release solid oral dosage forms, internal capabilities will provide an advantage overother companies in developing these products, executing these projects more skillfully, and increasing the probability of success while utilizing resources more wisely. The clinical team will be skilled at designing an optimum protocol and executing the studies required. The Regulatory Affairs team would be familiar with the technical and administrative nuances and expectations held by the Competent Authorities to allow for a smooth approval process, and the manufacturing units would be well equipped to supply a high-quality product at a competitive cost of goods.

Outsourcing: No one can do everything, and many products needed for the pipeline will be outside of the technical core competencies of the company. Competitive advantage can still be maintained through a highly skilled in- licensing team able to identify a reliable source of supply and negotiate and execute a highly competitive deal.

Expansion: This does not mean that once a company has developed a certain competitive advantage, it is locked into that niche. In fact, the opposite is true. New capabilities must be developed or acquired in order to remain competitive, and management must have the vision and the willingness to invest sufficient resources to maintain a competitive advantage. As our landscape becomes ever more crowded and sophisticated, the Portfolio Management function will be key to identifying future niches for expansion of capabilities.

C. Capacity and resources:

Matching the number of projects in the pipeline to the capacity and resources of the organization cannot be overlooked and provides another example of the integrated view and close collaboration with stakeholders that the Portfolio function needs to manage.

As a Portfolio Management consultant, I was once involved in a project that failed for this very reason. The financial objectives called for a fairly modest development pipeline to achieve 4 new dossier submissions per year. Upon calculating available resources, we found that we would need to add about 20 FTEs. Of course, there was no available space for 20 new people or equipment for them to work on. It became clear very quickly that while senior management was anxious to commercialize four, new products each year, there was no capability or desire to invest in the additional resources that would be necessary to enable this outcome. By implementing a broad portfolio management approach, we recognized this substantial disconnect during the mapping process and were able to cancel the project before significant monies were spent. Side note – it is always better to fail early.

Governance

In summary

If I had to create a “generic” mission statement for the Portfolio Management function I would say: “Deliver value to shareholders through consistent profitable growth, obtained via on-time launches of the portfolio of products that gives your organization a competitive advantage.”

Modern portfolio management is a far beyond picking the next blockbuster to genericize. Portfolio management is about taking ownership of the overall process of New Product Introduction from ideation through stable launch. This will be achieved using sophisticated tools and excellent people skills to facilitate on-time delivery of the new products that drive the profitable growth according to the objectives of the organization. Each step in the process needs to be managed including, but not limited to carefully curating a portfolio that fits the needs of the organization and provides a steady stream of growth over the short, medium and long-term horizon. A mindset of ownership at every step of the process should be the first point in the job description. Have the courage and the integrity to be the CEO of your NPI process, even when that authority is not formalized in the organization. Many stakeholders are involved in the execution, and still, it is the Portfolio Management function that is accountable for delivering value to shareholders. With this in mind, remain vigilant and consistently proactive. It takes an incredible level of knowledge and experience and even courage to know when and how to respectfully challenge stakeholders and achieve the consensus, cooperation, collaboration and execution that are essential to realizing these goals.

Exclusives

By Mike Teiler