Portfolio management as we know it today in the generic pharma industry is a relatively new discipline. The term was not in general use as recently as 15 – 20 years ago and applied to stock brokers, not pharmacists. To understand the foundations of portfolio management we need to look to the very foundations of the generic industry itself.

In the 1980s and ‘90s there were important changes to international legislation that had fundamental impacts on the pharmaceutical industry and especially generics. The main drivers were The Drug Price Competition and Patent Term Restoration Act, better known as the Hatch-Waxman Act passed by the US congress in 1984. Hatch-Waxman created the legal framework to incentivize generic companies to bring cost-effective products to market sooner, streamline the process for generic pharmaceutical approvals while also preserving incentives for innovation, including the creation of data exclusivity and patent term extensions for innovative pharmaceutical products.

The Hatch-Waxman Act established the legal and economic foundation for today’s generic pharmaceutical industry. Together with the “Bolar Provision” which considered that R&D work performed in the US to achieve US FDA regulatory approval was not considered to be patent infringement in the US, these legal developments were central to shaping the environment that cultivated the generic industry.

At roughly the same time, the World Trade Organization (WTO) then known as GATT, was working to harmonize the rules around how intellectual property protection would be applied internationally in order to foster free trade between nations. It was particularly the “Uruguay Round” that led to more global harmonization of exclusivities and patent terms, though the “Bolar Provision” and data exclusivity were not applied uniformly across nations.

This developing legislation not only shaped the rules governing what would soon become the biggest generic market in the world, but also how the industry in different countries would be impacted.

US companies could develop for US registration (though not for export.) Many Western European countries, not having a Bolar Provision, were prevented from developing generic drugs locally for day 1 launch (anywhere in the world!), while their Central and Eastern European, Canadian, Indian and Israeli counterparts had no such limitations. While the EU eventually got their own Bolar Provision, the impacts of that delay are still prevalent in the mechanics of the European generics market.

As a result of these legislative developments, the rules governing the generics market emerged and provided for a clear structure around which the generics industry formed. The nascent industry provided for a target-rich environment and a robust generics market began to form. With a large number of generic opportunities, there was little need for a sophisticated portfolio management process. New product selection was largely technology driven and R&D often the dominant force in the selection process, identifying the “low-hanging fruit.” Oral solids emerged as the dominant dosage form, in direct proportion to their prevalence of use in the market. Western European companies also tended to be R&D and technology driven for a totally different reason. As mentioned, Western Europe had no Bolar provision and as a result, focused more on differentiated products in development while in-licensing “plain-vanilla” generics from countries where development during patent protection was permitted.

Except for Western European manufacturers, IP considerations in these early days were less prevalent, partially because the number of opportunities was relatively high, and partially because the newly formed “Paragraph 4” procedures and the 180 day “generic exclusivity” promise were less widely appreciated. There were also far fewer “listed” patents for Reference Listed Drugs (RLDs) than we find today.

As mentioned, R&D was often a driver of the portfolio process as pipelines tended to be technology or capability driven, especially in companies where senior management was technologically inclined. However, in companies where the leadership consisted of commercially oriented managers, the business development teams often took the lead. In many cases, especially in smaller companies, it was the CEO alone who identified opportunities and instructed which new products should be selected for development. In any case, prior to the early 2000s it was rare to find a dedicated portfolio function anywhere in the generic industry, or anyone with the description “Portfolio” in their title.

It was only toward the late 1990s when opportunities began to thin out, and the broader industry began to recognize the huge value of the 180-day generic exclusivity that more sophisticated IP analyses became a routine part of the portfolio selection process, and better financial control of the pipeline became a necessity, at least in the largest generic companies. It was at this time that true portfolio management processes began to crystalize, though this name was still yet to be heard in the industry.

Lessons Learned

Adapt, adapt, adapt!

The industry gained experience. The landscape of immediate-release oral solids opportunities began to dwindle, while at the same time competition increased and players became ever more sophisticated. Legislation continued to react to industry practices, ongoing litigation, and court rulings. Pipelines were growing, older products once commercialized began eroding in value and companies needed to identify a steady stream of new products to maintain their growth objectives.

The most important lesson learned was that the strategies, tactics and methodologies that got us to where we were would not be sufficient or appropriate to support future growth. Adaptation to the ever changing competitive and legal landscape would be critical to the continued success of building a portfolio.

Challenges and Opportunities

The 1980s and ‘90s could be characterized largely by opportunism, the 2000s were characterized by ever more sophisticated patent challenges to drive “first-to-file” opportunities to capture the 180-day generic exclusivity. At the same time, companies were moving to more technically challenging dosage forms where there was less competition.

This included modified release oral solids, parenteral products, topicals, with a small number of companies focusing on ophthalmic, respiratory and long-acting injectables. Companies began looking at select proprietary 505(b) (2) opportunities where there would be less competition and attract higher prices in the market.

Although potentially attractive commercially, the proprietary space had a number of challenges as well, especially higher development costs and the fact that market access was very different from the substitutable generic model that was the industry practice. Such high risk-high return opportunities were hand-picked and rare in light of the high costs and risks involved. Many such projects failed either in development or commercially, though there were also a number of spectacular successes.

In the last decade we have been witness to a number of additional changes and challenges. FDA created the oxymoron known as “shared exclusivity” granting so-called “exclusivity” to all companies filing Paragraph 4 challenges on the same day. With multiple filers on the target “NCE-1” date, in some cases as many as 25-30 (!) all potentially launching on the same date, the attractiveness of NCE Paragraph 4 filings was severely reduced.

Consolidation among buyers/wholesalers has added further downward price pressure on generics, further challenging the viability of the generic business model.

In an effort to continue to identify low-competition products, numerous companies started looking to even more complex and expensive generic development projects including drug-device combination products, peptides, long-acting injectables (sometimes a combination of all three!) and, the highly expensive bio-similars. To remain competitive in the generic space, companies are finding that the investments or expenses involved in developing a single product have increased exponentially, with bio-similars commanding budgets approaching $100 million.

Some companies have been quite successful in developing products that I like to call “true first-to-file” opportunities. These are also known as EFTF (or Early First to File) projects. These are products that have no NCE “target” drawn on their backs, and hence it is less likely that there will be numerous companies filing on the same day. In these cases, the 180-day generic exclusivity “prize” is granted to the company that is fastest on the draw. All other filers will have to settle for market entry on “day 181,” just like we saw for NCEs before the “shared exclusivity” rules were affected.

In practical terms this means pursuing innovator “lifecycle management” follow-on products, or 505(b)(2)s commercialized by other generics. The spoils will go to the companies that can identify these opportunities early, even before they are launched by their originators, and can complete development and submit an ANDA at the earliest possible date. To this end we have been witness to companies with the ability to complete bioequivalence studies in a mere matter of days!

We are also witness to an ever increasing number of examples of companies launching “added-value” generics. These may be “ready-to-use” injectables, or strengths or presentations which make it easier for the patient to take their medication, or for health care providers to prepare and administer them.

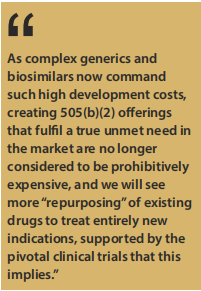

As complex generics and biosimilars now command such high development costs, creating 505(b)(2) offerings that fulfil a true unmet need in the market are no longer considered to be prohibitively expensive, and we will see more “repurposing” of existing drugs to treat entirely new indications, supported by the pivotal clinical trials that this implies.

Two last points that are critical to managing a successful portfolio. First, it is of critical importance to cancel projects as part of the process and there are numerous reasons why a once attractive project must be abandoned, some internal and others external to the organization. For one, once hands-on development begins, new complexities may be identified that were unanticipated when the project was first selected. Another common issue is encountering project delays that will postpone product launch and dramatically reduce the value of the project.

External factors include expected new competition (greater than originally considered), changing demand for the product in the market due to alternative products which become available, changes in customer behaviour, and supply and cost issues, just to mention a few. Cancelling a project is never a popular decision and there will always be some stakeholders who object, but once it becomes clear that the value proposition has deteriorated, there is no justification to continue to expend resources on a project that will not bring in the desired returns, and we are obligated to dedicate those resources to more valuable projects.

Second – when deciding to cancel a project, “sunk costs” must not be considered. Monies spent are never coming back! The only consideration should be how much future investment is required to achieve how much future value, and compare these figures to other, alternative projects. Emotionally it is highly challenging to let go of a project that we’ve invested significant resources to, but recognizing the emotional aspect is the first step in learning to ignore it!

The earlier we can identify a project for cancellation the better, as expenses and resources increase substantially as a project progresses. Thus, having an effective governance process with regular pipeline reviews is critical to portfolio management success.

Digitalisation and Innovative Technologies

Employing a sophisticated methodology for crafting a valuable portfolio is more important than ever. As discussed above, the challenge to identify generic candidates with less competition is growing more challenging, seemingly by the day. While the number of NCE candidates remains fairly consistent, the competition for these products is ever increasing. In fact, many companies are opting out of NCE opportunities entirely! Technologies and therapeutic areas which once had less competition, e.g., dermatology, have become crowded, and it is no longer sufficient to master complex technical capabilities to ensure low competition.

Even EFTF opportunities are becoming more competitive. The ability of a portfolio management team to identify the diamonds will be enhanced greatly by having algorithms for searching out those new products that meet all of their portfolio criteria, both technically and commercially.

Management demands have also increased. In the past many organizations were happy to approve new projects based on intuition and very “high level” data. Increasingly, corporate management is demanding robust financial modelling and justification for each and every new project proposal, and prioritizing new candidate selection based on the results of these analyses, in order to minimize risk as much as possible.

Not only does this require more sophisticated economic analysis, but also best in class business intelligence. The dual aspects of finding the ever dwindling needles while identifying new haystacks and creating robust financial models to justify investment, only serve to enhance the challenges to the portfolio management function to accurately predict the future.

Finally, we must consider the speed at which new product opportunities can be identified and approved. New project evaluation is performed by a multidisciplinary team, with resources “borrowed” from the different scientific and technical functions. Rarely is this activity the first priority of these resources and without an automated system to alert the portfolio team to delays, much time can be lost during evaluation. Even worse, as any experienced project manager knows, decision making in the face of uncertainty, especially by overburdened top management, is often the longest delaying factor in any process.

Thus, having a system in place to support the process, track new project approvals and alert the process owner of delays can be a very valuable tool. Shortening the time from ideation to project initiation will be a key success factor in bringing new products to market on time, and, from my own experience I can tell you that this time savings may well mean the difference between being first to market, and being last!

Traditionally, electronic spreadsheets (such as MS Excel) have been used extensively for portfolio management. Many organizations still use pen and paper to authorize new projects for the pipeline. Various automated “Portfolio Management” or “Life-cycle Management” (LCM) tools are available today to help facilitate work-flows and tracking of the review and sign-off process. Such systems are valuable in numerous ways.

First, all stakeholders have transparency of all the relevant data in the system to facilitate faster evaluation. As a result, everyone sees exactly the same data. Dashboards, KPIs and automatic alerts can be created within the system, which help to keep stakeholders focused on their pending uncompleted tasks and delivery dates and to help process owners to measure on-time execution by each resource.

Another benefit is that once data is entered into such a system it remains as an archive of decisions made and can be revisited when company strategy changes for re-evaluation. The same data, once entered in the system for evaluation must be made automatically available in simple and comprehensible fashion as each project idea or approved project advances to the next stage of evaluation, approval for development, and project initiation in the project management system.

Having good work-flows and enterprise level data systems are helpful tools, though they are not a substitute for the creative processes required to out-think the competition. In time, I believe that we will see machine learning/deep learning algorithms that can assist the portfolio management team in processing the huge volumes of data available, generate and assess new opportunities, and place some value on each opportunity. At the present time, however, task management and work flows seems to be the state of the art, and it may be some time before someone takes up the challenge to develop the “artificial intelligence” algorithms to start moving portfolio management into the AI age.

Collaboration and Communication

The sophisticated enterprise management systems described above are very helpful tools in facilitating collaboration and communication between the different functions in the organization. However, these are only tools to support a comprehensive governance process.

Too often we hear about “the handshake” between the portfolio team and the project management team. I get very nervous when I hear talk of this “handshake” because it implies that once hands have been well shaken the portfolio team washes their hands of responsibility, and all responsibility now lies with the project management team.

Surely the new candidate assessment and selection process is a discrete task and those performing it have their own skills, expertise, responsibility and accountability for a well-researched, well-reasoned and timely process. Similarly, project management is a professional expertise with skills and capabilities that are unique and invaluable to timely project execution. I like to consider each of these functions like runners in a relay race. In a relay race team each individual runner has to run their own leg of the race, however, it is the team that crosses the finish-line first, not the individual with the fastest time that wins the race.

Portfolio management is not limited to any one specific function, but rather must act as the team coach and coordinator to optimize the performance of the team. Portfolio management may retain the professional responsibility for new candidate selection, however the real accountability of portfolio management is in creating an overall governance process from ideation through commercial launch, facilitating consistent delivery of on-time, (hopefully) first-to-market product launches with reliable on-going supply.

This does not mean that the portfolio management team is responsible to execute each of the tasks from ideation through launch and, in fact, may not be responsible to execute any of these activities. The true accountability of portfolio management is in assuring that the end-to-end process is in place to support the organizational goals for growth, and in facilitating the availability of the resources and tools to make sure that this happens.

Corporate Strategy and Culture

Portfolio strategy does not exist for its own sake, but rather is a means to an end. In the pharma industry growth is driven by new products introduced into the market, while existing products, after an initial period of growth tend to erode in value over time. The objective of portfolio management is to shape the new and existing product pipeline to deliver the revenue and profit growth objectives set out in the corporate strategy.

The portfolio management team, in concert with senior management and corporate functions needs to identify the new product candidates that meet not only the growth targets but also matches corporate’s appetite for risk and leverages the core competencies of the organization.

Breaking this down into its component parts, we need enough projects of sufficient cumulative value to reach the revenue targets set by management. This may mean a larger number of lower value projects, or a smaller number of higher value projects. The former strategy should translate to lower risk as the portfolio is more diversified. In the latter strategy, with fewer projects, each of higher value, any project failure could put the portfolio objectives in danger, thus higher risk. In addition, for a high-risk project to justify itself, it would have to pay a risk premium, if successful.

As a general rule, a robust portfolio will contain a few high risk (high return) projects, and a larger number of lower risk projects, even if these deliver more modest returns. The exact ratio of low, medium and high risk projects will very much depend upon the company culture and risk appetite.

Another interesting aspect of how company culture may impact portfolio strategy has to do with the orientation of the management team. I’ve noticed that companies managed by lawyers tend to be more focused on patent challenges and litigation, while those led by physicians tend to have a more therapeutic focus, and those managed by pharmacists a more technological bias. Companies managed by economists or leaders having a strong commercial background have always demanded more robust financial modelling to justify new product selection.

Strategies and Core Competencies

This brings us to core competencies. Just to be clear – when we talk about “value” we must mean the value of a project to the organization, which has very little to do with the value of the RLD in the market, and everything to do with the level of competition upon market formation at the time of launch. With high competition, supply is high and prices will be driven down to the point that only the most efficient manufacturers will survive in the market over time. When competition is low, prices remain higher and revenues and margins are healthier.

What is the key to winning in the competition war? Stay with your core competencies, the things that you do best and give your company a competitive advantage. Core competencies may be technical or commercial, or may derive from an expertise in understanding the intricacies of intellectual property, or complex regulatory strategy, for example. In order to gain a competitive advantage, focus on core competencies.

This does not mean that you should not be exploring and developing new capabilities and technologies. Quite the opposite is true. If your core competencies remain the same over many years the company will stagnate and fall behind. Other players will catch up and these core competencies will no longer bring a competitive advantage. It is imperative to continually improve and upgrade core competencies in order to stay ahead of the competition. For portfolio management the message is to prefer projects based on the company’s strengths and expertise. If two projects have the same value, choose the one that your core competencies will give you the competitive advantage compared to most other players.

To give one illustrative, if obvious, example, if your company excels at developing highly complex extended-release oral solid products, you will want to take advantage of this expertise and exhaust all opportunities (of sufficient value!) in this technology platform, before choosing to develop a totally different technology, e.g., an ophthalmic suspension product. This does not mean that you should not be working on developing another expertise, recognizing that at some point these opportunities will be exhausted. When identifying the next technology to invest in, start “close to home,” and explore those technologies that are the closest to your current expertise. This minimizes the learning gap as you broaden your core.

In summation, first, don’t abandon your core! Your core competencies will drive your competitive advantages allowing you to be better, faster and cheaper to market than the competition and allow you to succeed where others may not, and face less competition in the market.

Second, don’t rest on your laurels! The core competencies that got you here will not be enough to get you to the next plateau. Continue developing additional skills and turn them into core competencies. It is more efficient to build on existing strengths when broadening core competencies. Only when these opportunities have been exhausted, start to break truly new ground.

Resources and Objectives

As discussed earlier, portfolio management is not an island unto itself, but rather a powerful tool to deliver corporate objectives of profitable growth. These objectives will dictate an annual growth target in e.g., sales, profit, or market share. These goals need to address the short, medium and long term as the company will strive for continued and steady growth from year to year. To reach this growth, as we have said, the company will need a certain number of projects to be selected, initiated, developed and submitted to the Competent Authorities (CA) each year.

Let’s understand this better through example. An organization has an appetite for growth and has set an objective. Portfolio management translates this into a clearly defined list of projects that need to be delivered over a period of time. To execute these projects resources are needed including the number of people with the right skill sets to do the work, the budget to fund it, sufficient lab/pilot/manufacturing space, and the right types of equipment in sufficient quantity to handle the work load prescribed.

The next question is, do we have these resources available and are we willing to dedicate them to our new product introduction (NPI) effort. In other words, are resources aligned with growth targets? Often, the appetite for growth exceeds the ability or the willingness of the organization to make the investments dictated by the portfolio plan. If the availability of resources cannot support the number of projects required, something needs to be realigned in the corporate strategy.

Soft Skills versus Technical Skills

Most of the conversation up until now has focused on the technical side of the business. What are my core competencies? How do I provide a robust financial justification for new projects? Do my resources align with my growth strategy? What tools are required to support good and timely decision making? These are all critical questions to be considered in portfolio management, to be sure. However, we must not neglect what is perhaps the most important part of the portfolio management equation which we can call the soft skills of portfolio management.

The most important responsibility of the portfolio management role lies in establishing and maintaining the ongoing governance process of portfolio management. This end-to end process starts with understanding the corporate strategy and translating this into an actionable plan. Often this will include negotiating with senior management and agreeing on just what that plan looks like. Then we need to establish the appropriate fora in which we can manage the many different aspects of the process to ensure that everything runs smoothly.

Portfolio management requires multidisciplinary inputs from across the organization as well as excellent coordination between stakeholders. For example, who needs to be involved in the new candidate selection process? We need R&D to assess and provide input on project complexity, budget, resources and timing. We need input on intellectual property to assess project timing and constraint dates, and the tactics needed to reach the market at the earliest possible date. Regulatory affairs needs to comment on complexities to be addressed with the CA. Commercial input is crucial to understand the value of the project given a complex competitive landscape, relationships with customers and desired product characteristics that have commercial impact (e.g., trade-dress and packaging configuration).

While all stakeholders hold the good of the organization as paramount in importance, each will have their own perspective on how each project and the pipeline as a whole impacts their own function. We need to bear in mind that each department has their own key performance indicators (KPIs) and that by their nature, these KPIs do not always align. Thus, it is the role of the portfolio function to be able to manage the interactions and potential clashes, and to negotiate the best outcome for the organization as a whole.

Finally, the end-to-end process needs to address every stage of the NPI process and manage each stage according to the changing circumstances. For example, the stakeholders required to select new product candidates may differ from those who need to be involved during the R&D stage review process. Once an ANDA/dossier has been submitted to the CA, and review letters are received, yet a different subset of stakeholders may be needed, and for launch management, the forum will certainly change again. Ongoing technical reviews may be required monthly (or even more frequently) while some stakeholder reviews only be required on a quarterly basis and senior management reviews might be even less frequent.

In each of these different interactions the portfolio management function is responsible for making sure that the right stakeholders are represented, that the right information is provided in an easily digestible format to facilitate efficient decision making, and perhaps most importantly, be at the nexus to smoothly negotiate any potential conflicts between stakeholders, which will inevitably arise. In short, establishing and managing a comprehensive end-to-end governance process is portfolio management’s key responsibility and critical success factor!

MIKE TEILER

MIKE TEILER

Mike’s career spans nearly 35 years in the pharma industry specializing in all aspects of portfolio management, new product introduction and project management. He received his training in Pharmacy at the Hebrew University of Jerusalem, where he earned his B. Pharm degree. He defines himself as an organizational integrator and seasoned consultant with broad experience in dynamic global environments.

Mike served at Teva Pharmaceuticals for 24 years in increasingly senior positions in Generic R&D and Portfolio Management, where he led the Portfolio Management team for Teva Europe, and, finally reaching the position of Vice President Generic R&D for the Teva International Group. After leaving Teva, Mr. Teiler joined Taro Pharmaceuticals (a Sun Pharma company) as Group Vice President, Portfolio Management, where he created this role and established processes for candidate selection, R&D project management, and global launch management. In addition, Mike was responsible for the project management of Sun Pharma’s R&D, where he was responsible for creating the Project Management function, introducing Critical Chain Project Management and led the implementation effort. Since leaving Taro in 2017, Mike has been working as a consultant, providing strategic portfolio management guidance to generic pharma and API companies as well as strategic biotech consulting and guidance to numerous startups in the pharma, device, cosmetics, and supplement space.